Bookkeeping 101: tips for entrepreneurs

Get the essential bookkeeping tips for a starting entrepreneur. See the accounting lay of the land before starting your new business and possibly your life's mission.

If you are a small business owner, you’re going to have to deal with bookkeeping. While not the most glamorous aspect of running your own business, it’s a must. It is an overwhelming subject. So, we’ve put together this article on the bookkeeping basics that is filled with bookkeeping tips for entrepreneurs.

WiseStamp does not provide financial advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, financial or accounting advice. You should consult your own accounting advisors before engaging in any financial transaction.

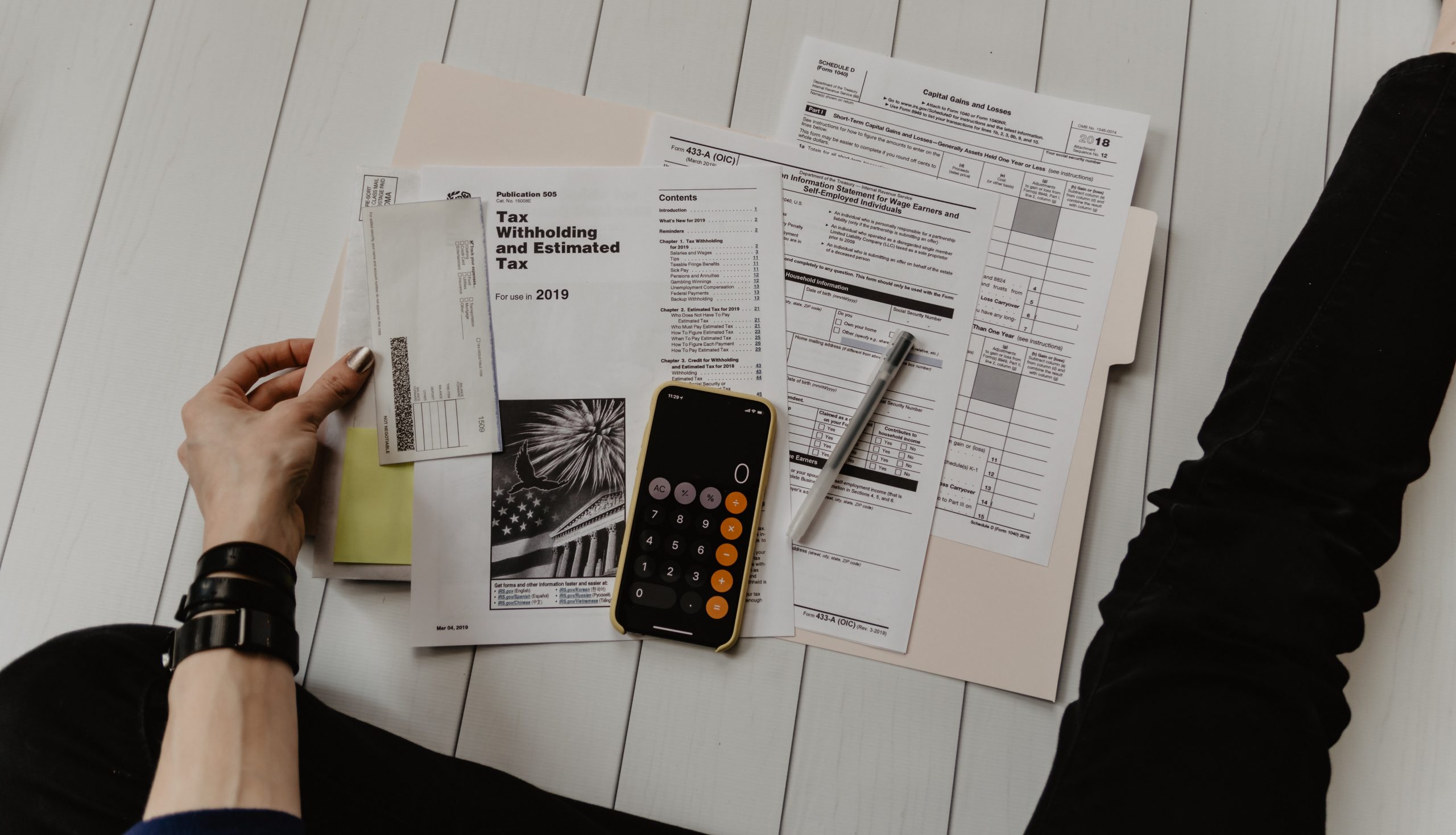

When you brush up on how to do bookkeeping, you will learn how to get more tax deductions, get a business loan in the future, identify financial mistakes, track where your money is going, and how much cash flow you have. As you can see, it pays to understand bookkeeping. That’s why we’re going to go over the most crucial bookkeeping tips for beginners.

Bookkeeping Basics

One of the most fundamental aspects of bookkeeping entrepreneurs should understand is the need to separate your business account from your personal one. When you separate them, you are going to benefit in the following ways:

1) Easily track business transactions – Stay more organized by setting up a separate bank account for your business. Bookkeeping will be more accurate and easier, especially during tax season. Also, bookkeeping will be faster.

2) Enjoy more efficient tax returns – Tax returns will be more accurate. You will enjoy a more streamlined record-keeping process due to identifying taxable benefits and deductions quicker and more efficiently.

3) Leave a clear audit trail – When you use a separate bank account for your business, you are more likely to avoid audits. When business transactions are separate, there will be a clear audit trail that makes any potential audits much less painful.

4) Have accurate cash flow management – Managing and reacting to whatever your cash situation is will be easier when your business finances are separated from personal ones.

Do you need more money? All you have to do is move some money around. Is there too much money laying around in an account? Put it to better use in another one. Getting loans or credit will be easier when you have clear financial records.

5) Establish business credibility and professionalism – You always want to ensure your business is credible in the eyes of the public, lenders, creditors, and everyone else. Keeping personal and business accounts separate demonstrates that you can be trusted by suppliers and clients.

6) Build up your business credit score – Build up your business’ credit rating by maintaining a separate account. This score will demonstrate the creditworthiness of your business. When it has good credit, you will get better terms for any loans you apply for and lower any insurance you get for your business.

Avoid legal problems that sometimes come with a joint account and simplify your life by splitting up business and personal finances. This is something that is especially important for C corporations.

Different Entry Types

Now that we have established the importance of maintaining a separate account for your business, we’re going to get into some bookkeeping basics involving entry types. There are two main types: single entry and double entry.

1) Single Entry – This system of bookkeeping involves making an entry for every single financial transaction your business conducts. Transactions are only recorded once.

This system is used to keep track of transactions that involve cash receipts and disbursements. Sole proprietorships and partnerships will find this system to be best suited for them. There’s more need for advanced knowledge of how to enter transactions.

2) Double Entry – When this system is used, every transaction will affect two accounts simultaneously. One account will get debited while another gets credited.

The two-fold nature of this system means that there is a completeness to it. It’s also accurate enough to fall under the Generally Accepted Accounting Principles (GAAP).

The process uses source documents, then a journal, ledger, and trial balance. Finally, financial statements will get prepared. Big companies use this system.

Cash Accounting vs. Accrual Accounting

If you want to know how to do bookkeeping, you will need to know the difference between cash and accrual accounting. Here’s how these two accounting styles differ:

1) Cash Accounting – This is a quick way to recognize revenue and expenses. This is a more straightforward accounting method that recognizes income only when you receive it, such as when it enters your bank account.

2) Accrual Accounting – This is the most popular accounting method, particularly for large publicly-traded companies. It recognizes income when it is earned. It will display a more accurate picture of the financial health of a company, given its inclusion of both accounts payable and accounts receivable.

Basically, cash accounting recognizes revenue and expenses right away, while accrual accounting places focus on the anticipated revenue and expenses.

How to Choose a Bookkeeping Method

One of the most important bookkeeping tips for entrepreneurs we can give is to pick a bookkeeping method and stick with it. There are two primary bookkeeping methods used today: spreadsheets and accounting software.

1) Spreadsheets – Bookkeeping that uses spreadsheets will normally involve using a program like Microsoft Excel, although some entrepreneurs use the old-fashioned pen-and-paper method. When you use a spreadsheet program, you can easily get a free bookkeeping template that will help take the difficulty out of entering every transaction as it happens.

2) Accounting Software – There are many options available today when it comes to accounting software. The very popular ones used by entrepreneurs everywhere can be used for a monthly feel. Some of the current favorites are FreshBooks, QuickBooks, and Wave. While any one of these can make your life much easier, you still may need some help from an accountant to understand how to properly use them.

Categorize Your Transactions

At the core of bookkeeping, there are debits and credits. Credit is when money comes to you from somewhere. A debt is when money is going somewhere. For every debit, you need a credit to offset it. The opposite holds true as well. When you get this principle down, the rest of bookkeeping becomes much easier.

Another critical component of categorizing transactions involves accounts. There are several different types of accounts that any given transaction can be applied to. The main ones you will likely have are the following:

1) Assets – Assets are what your business owns. This could be something physical, such as cash, a bank account, inventory, or equipment. Assets can also be intangible, such as intellectual property.

2) Liabilities – When you take out a loan, you are incurring a liability. This means that you have received money that you will have to pay back to someone at some point. Accounts payable is the most common kind of liability. When it comes to AP, money is owed to a vendor and is paid at a later date.

3) Equity – When money is given to a business straight from the pocket of the owner, it’s considered equity. With equity, there is no expectation that the money will ever get paid back. Under the equity umbrella, there are a few accounts, namely Capital, Retained Earnings, and Dividends.

4) Revenue – When your business has revenue, it has received money from sales or services. These are payments usually made by customers and clients.

5) Expenses – Expenses are incurred when money comes out of your business in order to keep it operating. Expenses differ from investments. When it comes to expenses, companies will receive a one-time advantage of spending money. Investments provide long-lasting benefits, which is why they are considered assets.

Additional Bookkeeping Tips

We’re going to go over a few more bookkeeping tips for beginners that are important for any entrepreneur to know.

1) Differentiate Your Spending

One thing to remember is that you should differentiate what you are spending. For example, when you differentiate the money you spent on food versus the money spent on tech equipment, you will find it becomes easier to deduct that office equipment at the end of the year.

2) Organize and Store Financial Records

Make sure to expertly organize and store all financial records related to your business. For example, you should hold onto the proof of expense for any expenses over $75. Also, you should be storing every receipt and financial transaction your business conducted within the last three years.

This should be a bare minimum. Whether you keep them as digital or hard copies is up to you, although there is a growing shift towards digitizing all records.

3) Set Solid Financial Habits

While it’s not fun to hold onto every little receipt and track all transactions, you will be making things easier for your business. It will also benefit your business once tax time rolls around. Set solid bookkeeping habits so that you will make the whole bookkeeping process much less painful.

Wrapping Up

Now that you know the bookkeeping basics to run your business properly, you can enjoy having fewer headaches when tax season rolls around.

Beyond bookkeeping, you can also make life easier by ensuring every email you ever send from your business will feature your professional email signature.

Wisestamp has revolutionized the advertising real estate known as the email signature and lets you promote your social media accounts using icon add-ons. They are hyperlinks that directly take you to the social media account for business. Enjoy more attention to your business’s social media accounts and potentially create new business relationships and customers.

Join the email signature revolution by taking advantage of Wisestamp’s professional email signature icon add-ons.

** WiseStamp does not provide financial advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, financial or accounting advice. You should consult your own accounting advisors before engaging in any financial transaction.